Since mid-year 2022 economists, forecasters, rating agencies and investment research firms have been forecasting a recession that has officially not taken place. Now the conversation has shifted to what is the likelihood of recession in 2024 & beyond. Nevertheless, economists have a long history of getting their predictions wrong.

Are we in a recession?

The process of determining whether a country is in a true recession often takes time. The decision process involves establishing a broad decline in economic activity over an extended period, after compiling and sifting through many variables, which are often subject to revisions after their initial announcement. In addition, different measures of activity may exhibit conflicting behavior, making it difficult to identify whether the country is indeed suffering from a broad-based decline in economic activity.

We expect an uncertain economic outlook and significant slowdown in the economy for a year or few quarters even if we don’t dip into negative GDP growth and officially declare a recession. We realize nobody can accurately predict timing of a recession, however as multifamily investors we must learn from prior recessions and put ourselves in a position to capitalize on any buying opportunities that will come through due to current economic uncertainty.

Recession’s impact on multi-family

So, how does multifamily perform during recession? History shows us slowdown in economy increases demand for multifamily because people still need a place to live, and housing is a necessity. Because shelter is critical, apartments generally hold up better in recessions and adverse conditions than other types of commercial real estate categories.

During a recession people lose their jobs & often cut down their discretionary spending on travel, entertainment & dining. During this time liquidity is important, most people will not look to buy homes, which is a major purchase. It is challenging for people to qualify for mortgages during a recession as lenders originate less loans due to liquidity constraints, tighten their lending guidelines and scrutinize mortgage loan applications. It’s likely that the share of renters will increase during these uncertain times as more people are unable to afford a home, which makes them a renter by necessity.

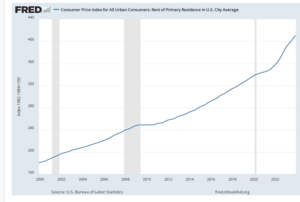

A study of multifamily’ s performance during past market cycles can give us an informed perspective of how multifamily may perform in the future. According to the U.S. Bureau of Labor Statistics, residential rents throughout the U.S. have generally risen each year except during recessions, when the pace of rent growth was very slow or simply flat.

Multi-family real estate is considered a hedge against inflation & is more flexible to rent raises as economic conditions change. In comparison, office, retail, and industrial properties often come with long lease terms. As leases expire, landlords can increase rents to existing or new tenants by at least as much as the annual rate of inflation.

Summary

During recession there are fewer real estate transactions & significantly less competition which can offer a pricing advantage to the buyer. Investing in recession can often provide a great opportunity to buy a great asset sometimes below replacement cost. If you are willing to invest for the long term and have a safety net, you might be in a good position to take advantage of great buying opportunities that could our way in next 6-12 months.