If you have a conventional IRA or a 401K plan with a mainstream custodian (bank, broker, employer etc.), your investments are typically limited to stocks, bonds, ETF’s, CD’s and mutual funds. These restrictions are often based on assets the custodians and/or IRA administrators recommend and sell. If you are heavily invested in the stock market, should you be diversifying in assets outside of stock market volatility? Have you ever considered investing your retirement funds in an alternative asset class beyond traditional options?

A self-directed retirement account is a tax-advantaged vehicle that gives investors the ability to invest in non-traditional options such as real estate, private equity, precious metals and cryptocurrencies. A Self-directed IRA or 401K plan can offer flexibility to invest in other assets and the opportunity to diversify outside of the stock market.

Individuals who self-direct their IRA and/or solo 401(k) enjoy the freedom and control these plans provide. Freedom lies within the massive number of alternative assets available to build wealth in these plans. And when you can invest in things you know and understand, you gain control over how your investment dollars are spent. Those who are savvy in business can invest in startups or distressed companies looking for a boost of capital to revamp. Venture capital and angel investing opportunities are permissible assets in self-directed plans.

Why Invest your retirement funds in Real Estate Syndications?

- Diversification: If you happen to own single family rental properties locally or if your retirement funds are primarily invested in the stock market, investing in multi-family real estate provides sector diversification. If you are invested in REIT, in comparison to Syndications they have higher fees, limited growth potential, they are volatile & inefficient. Syndication adds less volatility to your overall investment portfolio.

- Better returns: Average risk adjusted returns in a multi-family syndication is in the double digits and is higher than the average returns of the S&P 500 Index. Primarily this is due to the use of favorable leverage in comparison to buying stocks, mutual funds, or ETF at full face value.

- Passive Investment: The operations of real estate syndication is the responsibility of sponsors, general partners & property managers. As a limited partner, your investment is entirely passive.

- Professional Management: Multi-family properties are managed by a third-party management company and assets managed by general partners in syndication. Property management can be a full-time job in and of itself. Trying to manage your own property can be a recipe for disaster if you don’t know what you’re doing! There are many Federal, State, and Local laws to adhere to. It’s better to leave property management to the professionals.

- Investment Expertise: You can invest passively alongside sponsors who buy millions of dollars in investment property. The importance of a track record in real estate cannot be underestimated. As a passive investor, you can invest your capital alongside those with incredible track records. Try doing that with single family rentals – it is much more difficult! You’re all on your own in that case.

- No Personal Liability: There is no personal risk because investment as limited partners do not require a personal guarantee from the lender.

- Tax advantages: All income generated inside a self-directed retirement account grows tax free. If this is done inside a Roth account, all distributions at the time of retirement age can be tax free as well. If you can generate a higher rate of return, it can be a great tool to grow tax free wealth.

UDFI or UBIT Tax Implications for IRA Investors

Syndications use a combination of investor capital (equity) and bank debt for acquiring multi-family properties. This use of debt financing produces exposure to tax on Unrelated Debt-financed Income. In a property with a 75% Loan to Value, that would mean 75% of the net income produced by the property is subject to UDFI or UBIT Tax. Similarly, the gain on sale of a property that used debt financing could also be subject to UDFI or UBIT tax based on loan to value.

The Solo 401(k) Exemption

If a self-directed solo 401(k) plan acquire real estate through an investment in a LLC syndication, and a nonrecourse loan is part of the transaction, IRS would not subject the rental income or capital gain as acquisition indebtedness. As a qualified employer retirement plan, a Solo 401(k) is exempted from UDFI when the debt financing is used for the acquisition of real property. Rules for UDFI or UBIT can be complex, it is highly recommended to discuss your situation with a seasoned tax professional.

Multi-family syndication can be an attractive investment opportunity for savvy investors who want to diversify their retirement portfolio into real estate investments without having to deal with the headaches of being a landlord. These are passive investments that can offer great tax advantages, an opportunity to grow tax free wealth, diversification of alternative asset class and higher profits than you would get if invested in the S&P 500 Index or stock market.

Further questions? Click here to schedule time with Sanjeev

Happy Investing!

How does Multi-Family perform during a recession?

Since mid-year 2022 economists, forecasters, rating agencies and investment research firms have been forecasting a recession that has officially not taken place. Now the conversation has shifted to what is the likelihood of recession in 2024 & beyond. Nevertheless, economists have a long history of getting their predictions wrong.

Are we in a recession?

The process of determining whether a country is in a true recession often takes time. The decision process involves establishing a broad decline in economic activity over an extended period, after compiling and sifting through many variables, which are often subject to revisions after their initial announcement. In addition, different measures of activity may exhibit conflicting behavior, making it difficult to identify whether the country is indeed suffering from a broad-based decline in economic activity.

We expect an uncertain economic outlook and significant slowdown in the economy for a year or few quarters even if we don’t dip into negative GDP growth and officially declare a recession. We realize nobody can accurately predict timing of a recession, however as multifamily investors we must learn from prior recessions and put ourselves in a position to capitalize on any buying opportunities that will come through due to current economic uncertainty.

Recession’s impact on multi-family

So, how does multifamily perform during recession? History shows us slowdown in economy increases demand for multifamily because people still need a place to live, and housing is a necessity. Because shelter is critical, apartments generally hold up better in recessions and adverse conditions than other types of commercial real estate categories.

During a recession people lose their jobs & often cut down their discretionary spending on travel, entertainment & dining. During this time liquidity is important, most people will not look to buy homes, which is a major purchase. It is challenging for people to qualify for mortgages during a recession as lenders originate less loans due to liquidity constraints, tighten their lending guidelines and scrutinize mortgage loan applications. It’s likely that the share of renters will increase during these uncertain times as more people are unable to afford a home, which makes them a renter by necessity.

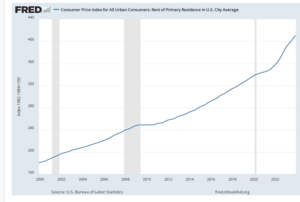

A study of multifamily’ s performance during past market cycles can give us an informed perspective of how multifamily may perform in the future. According to the U.S. Bureau of Labor Statistics, residential rents throughout the U.S. have generally risen each year except during recessions, when the pace of rent growth was very slow or simply flat.

Multi-family real estate is considered a hedge against inflation & is more flexible to rent raises as economic conditions change. In comparison, office, retail, and industrial properties often come with long lease terms. As leases expire, landlords can increase rents to existing or new tenants by at least as much as the annual rate of inflation.

Summary

During recession there are fewer real estate transactions & significantly less competition which can offer a pricing advantage to the buyer. Investing in recession can often provide a great opportunity to buy a great asset sometimes below replacement cost. If you are willing to invest for the long term and have a safety net, you might be in a good position to take advantage of great buying opportunities that could our way in next 6-12 months.

2024 Multi-Family Trends

2024 Multi-family Trends

Challenges

Multifamily is facing headwinds due to record new supply, with 900K units under construction and over 440K set to be delivered this year, per CBRE’s 2024 outlook. Performance varied by region and by asset class, but generally fast-growing sunbelt & mountain west markets are experiencing record new supply and a drop in asking rents, while the slower moving secondary or tertiary markets are generally expected to be the better performing markets.

|

Metropolitan Area Top 10 |

2024 Annualized Growth in Gross Income |

2024 Vacancy Rate |

Metropolitan Area Bottom 10 |

2024 Annualized Growth in Gross Income |

2024 Vacancy Rate |

| Oklahoma City | 3.6% | 5.9% | San Antonio | 1.4% | 7.8% |

| Albuquerque | 3.5% | 2.8% | Seattle | 1.3% | 7.3% |

| Tulsa | 3.5% | 4.7% | New York, Outer | 1.1% | 7.0% |

| West Palm Beach | 3.5% | 5.5% | Philadelphia | 1.1% | 5.9% |

| San Francisco | 3.4% | 4.2% | Fairfield County, CT | 0.9% | 7.0% |

| Riverside | 3.3% | 3.7% | Colorado Springs | 0.9% | 6.9% |

| Syracuse | 3.3% | 2.6% | Minneapolis | 0.6% | 7.8% |

| Little Rock | 3.2% | 4.4% | Washington, D.C. Core | 0.5% | 8.9% |

| Norfolk | 3.2% | 3.6% | Austin | 0.3% | 9.3% |

| New Orleans | 3.2% | 5.1% | Nashville | -0.1% | 9.3% |

| United States | 2.1% | 5.7% | |||

Source: Freddie Mac

Further, operational expenses such as payroll, insurance and real estate taxes have been up significantly reducing property’s Net Operating Income. To combat inflation, the federal reserve started raising benchmark borrowing rate starting in April 2022. After raising interest rates by a whopping 525 points, the federal funds rate currently stands at 5.25% to 5.5%, a level not seen since July 2007. Higher interest rates significantly reduce property cash flows, require higher equity to get financing & can cause property value to go down if rates stay high for longer.

Looking ahead

Economic data shows we have made significant progress towards bringing inflation down from the June 2022 high of 9.1% to the annual rate of 3.4% in December 2023. Despite aggressive rate hikes, the January 2024 jobs report was better than expected and unemployment held at a low rate of 3.7%. In July 2023 the Fed put a pause on its rate hiking campaign. But before bringing the rate down, they are looking for more data showing inflation is continuing to come down to their long-term target of 2%. At the January 31st meeting, the Fed indicated that it is done raising interest rates but made it clear that a March rate cut is unlikely. With the possibility of rate cuts towards the end of the year, it could bring buyers back into the market and spur multifamily lending volume for the year.

According to Freddie Mac’s 2024 Multifamily outlook, despite the short-term supply headwind, over the longer-term the multifamily market will continue to be supported by the overall shortage of housing, an expensive for-sale housing market, and the next generation of renters entering prime renter age. Per CBRE’s 2024 outlook, Multifamily real estate is playing a more important role in alleviating a severe shortage (at least 3.1 million) of single-family homes that is contributing to homeownership challenges, particularly in a high-interest-rate environment. The premium for an average monthly mortgage payment of a newly purchased home vs. average monthly rent is expected to remain above 35% in 2024 versus 52% in 2023.

The opportunity

Investors hoping for major distress like 2008-2012 may be in for a big disappointment. Despite all the challenges, the fundamentals for multifamily are healthy, demand for multifamily is still strong, there is no banking crisis & there is plenty of dry powder waiting on the sidelines simply waiting for the right deal. If distress does hit the market, it will be short-lived & institutional capital will return resulting in a competitive environment. Owners who purchased multifamily properties in 2021 & 2022 on floating rates with overly optimistic rent growth assumptions and did not execute their business plan are the primary candidates who may be facing cash flow challenges & be in a difficult position to sell. However, if the interest rates drop significantly in the next 6-12 months, some may be able to refinance and defer the sale until the market recovers.

The overwhelming majority of new supply of apartments is Class A construction, however work force housing class C and renter by necessity class B properties, may not see significant reduction in demand. The window of distress opportunity will be short, we can’t time the market, however the next 12 months are likely to present a good buying opportunity. There is a lot less competition today and if we buy in an area with good fundamentals and demand, we will do well as long as property cash flows. We simply wait for an opportunistic time to refinance at a lower rate & sell when cap rates compress thereby increasing the value of property.

Sincerely,

Sanjeev

If you have any further question or are considering investing, Click here to schedule time with Sanjeev

Is Multi-Family Syndication right for you!

So, you have done your homework on real estate investing and have concluded multi-family syndication is the way to go. You love the idea of double-digit returns passively & tax advantages from the ownership of physical assets, like real estate. In addition, multi-family syndication can provide geographical & asset class diversification while reducing your overall portfolio risk.

However, multi-family syndication may not be the right fit for everyone. We all have a varying degree of risk tolerance, different investment goals, and varying time horizons. Therefore, it is prudent to evaluate YOUR financial situation before investing in any real estate syndication.

Let’s move on to evaluate key factors to determine if real estate syndications may be a good fit for you.

Minimum Investment: Unless you are investing in a crowdfunding site, most real estate syndications require a minimum investment of $50,000.

Illiquid for hold period: Your investment in a real estate syndication may not be easily transferable or salable, which makes it an illiquid investment for the entire holding period.

Inconsistent Income: Many syndicated real estate investments vary by strategy to improve net income from operations. Some examples are: major renovation, heavy value add or development. Such projects are considered heavy lift and typically may not cash flow in the beginning or may not cash flow at all during the hold period. These projects can be highly profitable from a capital gain perspective and may not be a fit for income-seeking investors.

Passive Investment: The operations of real estate syndication is the responsibility of sponsors, general partners & property managers. As a limited partner, your investment is entirely passive. You likely won’t ever see the asset and will not be involved in any day-to-day decisions or have any control over the investment.

Investment Period: Most syndications have a hold term of five years or more, although it can be a little more or less.

Accredited Investor: Most sponsors require you to be an accredited investor to participate in the real estate syndications.

Multi-family syndication can be an attractive investment opportunity for investors who want to diversify their portfolio into real estate investments without having to deal with the headaches of being a landlord. These are passive investments that can offer great tax advantages and higher profits than you would get if invested in the S&P 500 Index or stock market. However, just like any other investment vehicle, real estate syndication has its pros and cons, so it’s important to engage in due diligence and carefully weigh the pros and cons before you commit. If you’re in the market for an opportunity that will take care of operational details while you focus on your personal goals, syndications may be worth exploring further.

Further questions? Click here to schedule time with Sanjeev

Happy Investing!

Why invest in multi-family syndication?

Are you tired of the volatility of the stock market and want to diversify into a safer investment? Do you like real estate because it is stable in comparison to the stock market, and it is a hard asset?

While exploring several options like starting with buying a rental property. It isn’t unusual to realize that most single family rentals in your local area do not cash flow unless you put a hefty down-payment. And if you live on either coast, rental laws favor the tenants which makes it even harder to get a good return on your investment. Maybe you’ve considered fix and flip as a side hustle, but realized it takes too much time to find a deal and a lot of effort in rehabbing and selling. And finally you’ve stumbled upon REIT’s (Real Estate Investment Trust) – just like stocks or mutual funds easier to buy, sell and manage but you don’t like the volatility of the stock market.

Well, let’s explore why investing in multi-family syndication could be an excellent choice for passive investors with lower volatility, better returns, and a great diversification play!

- Passive Investment: As a limited partner, there is no responsibility for maintenance or operations of the property making it truly passive & hassle free.

- Ownership benefits: You still enjoy all the benefits of ownership: cash flows, appreciation, equity build up and tax advantages.

- Lower Investment barrier: Unless you can buy an apartment complex on your own, for a minimum investment of $50,000 you get to invest in an institutionally quality asset that otherwise you wouldn’t be able to transact on your own.

- Professional Management: Multi-family properties are managed by a third-party management company and asset managed by general partners in the syndication. Property management can be a full-time job in and of itself. Trying to manage your own property can be a recipe for disaster if you don’t know what you’re doing! There are many Federal, State, and Local laws Leave the property management to the professionals.

- Investment Expertise: You can invest passively alongside sponsors who buys millions of dollars in investment property. The importance of a track record in real estate cannot be underestimated. As a passive investor, you can invest your capital alongside those with incredible track records. Try doing that with single family rentals – much more difficult! You’re all on your own in that case.

- Newbie Mistakes: Newbie mistakes in real estate can be costly, so it’s important to know what to avoid. Experienced syndication sponsors are not rookies, and while they are human and can make mistakes, they will have learned many tough lessons from the past deals.

- No Personal Liability: There is no personal risk because investment as limited partners does not require personal guarantee from the lender.

- Diversification: If you happen to own single family rental properties locally, investing in out of your state real estate provides geographical & sector diversification. This adds less volatility to your overall investment portfolio.

- Better returns: Average risk adjusted returns in a multi-family syndication is in double digits and is higher than average returns of S&P 500 Index. Primarily this is due to use of favorable leverage in comparison to buying stocks, mutual funds, or ETF at full face value.

- Funding Options: You can fund a passive syndication investment in many ways. Cash, retirement accounts such as self-directed IRAs, QRPs/Solo 401(k)s, Life Insurance plans, you name it. There are even ways to invest in syndications through a 1031 Exchange.

To Summarize

Multi-family syndication investing can be a great way to diversify your investment portfolio. You can participate and diversify in variety of ways without having to do the work on your own. However, this investment strategy is not for everyone. Not all investors are comfortable investing for a 2–5-year hold or giving up control in the operations of their real estate investments. If you’re in the market for an opportunity that will take care of operational details while you focus on other personal goals, syndications may be worth exploring further.

Further questions? Click here to schedule time with Sanjeev

Happy Investing!

Have you wondered how the fee structure in a syndication is broken down? There are 4 main fees associated with syndication deals, but it is also important to understand the profit sharing structure between general and limited partners. Fee structure can vary depending upon the syndicator’s track record, degree of risk, complexity of project, varying degree of value add, current market conditions and hold period. So let’s get right into it! Keep in mind, most value add apartment syndications are based on 3-5 years hold period.

The Four Most Common Fees in Syndications

- Acquisition fee: This fee is charged by syndicators & shared among general partners for work involved in putting the whole deal together and is usually 2 to 4% of the purchase price. Fee is paid to the syndicator at the time of closing the deal.

- Asset management fee: This fee is paid to general partners on a monthly basis for project managing every aspect of the property: legal, construction, renovation, accounting and operations. It can be a flat fee or range between 2-3% of property’s monthly rental collections.

- Refinance fee: This fee is paid to general partners for work involved in obtain a new or permanent loan. This may apply If the business plan involves refinancing the property to return a portion of capital back to limited partners. It can range from .5% to 1.5% of the refinanced amount.

- Disposition fee: This fee is paid to general partners for work pertaining to selling, listing, disposal of the property as well as legal and accounting responsibility pertaining to dissolving the company post sale.

Now that we have defined the common fees, let’s now talk about the profit sharing structure and what is entailed in that. The fees listed below are paid to the syndicator directly from the equity raised and profits of the deal.

Two Types of Profit sharing structures between General and Limited Partners

First, we have the Straight Split Structure

This pay-out structure splits cash flows from investment & profit from sale based on split. For example, 75/25 split would mean 75% of cash flows during the holding period would go to limited partner and remaining 20% goes to general partners. Upon sale of property, limited partner capital will be returned and remaining profit, no matter how much would be split 70% to limited partner and 30% to general partner.

Next, we have the Water Fall Structure

This pay-out structure can be quite complex as it provides preferential return to limited partners before general partners receive their share. Unless syndication returns over preferential return, GP does to participate. Splits may change if a certain return threshold is achieved thereby incentivizing general partners to outperform. Below is a typical water fall structure although it will vary from project to project.

- Up to 7% preferred return to LP, 80/20 Split

- Catch up by GP on preferred return on their share of split

- Up to 12% return 80/20 Split

- Returns over 12% are based on 65/35 Split

The fees listed above are paid to syndicator directly from the equity raised and profits of the deal. Now that we have outlined the profit sharing structure, a potential investor should read & understand the operating agreement & private placement memorandum. One tends to feel a higher degree of comfort level investing in something that we understand.

Further questions? Click here to schedule time with Sanjeev

Happy Investing!